“I am sorry Dave, I’m afraid I can’t do that - 2001:A Space Odyssey”

I have been off on a (well deserved) holiday, and so there has been a bit of a radio silence. Now I am back, there will be a brief flurry of posts while I catch up.

Is DEI as important with the investor as with the investment?

Sometimes when we talk about sustainability, especially climate, we often focus on the technology or regulation. This means we often forget the most important element in any change or transition - people. This has two aspects. First, how will our customers (or consumers) respond? Will they adopt the new way of doing things (electric cars, industrial heat pumps etc) or will inertia mean change either doesn’t happen, or if it does, it’s not financially viable. If the new ways of running our economy do not get traction, then all of our plans and targets are just that, dreams not reality. And of course, the important question around our investments - are they contributing to a just transition, or are they exacerbating already severe stresses?

Perhaps even more important on the people front - the people we work with. This is multi faceted. It covers recruiting the right people, training and motivation, and the big one. Diversity. True diversity in our workforce, among our suppliers, and within the companies we partner with, is one of the strongest sustainable advantages a company can create. Unlike technology, its tough to replicate, and if you do it well, it can lead to more innovation, better customer service and stronger loyalty. But, this is a lot more than just a box ticking exercise.

We have discussed the topic of diversity, equity and inclusion (DEI) in a number of blogs previously (click on the image to read).

A key facet of sustainability is getting the most constructive impact for society as a whole with the most appropriate resources that we have. That is often people. Those people can have different backgrounds, different ways of thinking and different starting points. With an equitable view point we can create a culture that includes these diverse viewpoints and skills for the benefit of all.

So far in The Sustainable Investor, we have discussed DEI in companies and ultimately in the performance of their listed securities, i.e. investments. And what about those doing the investing: the fund managers?

Hello Dave

At this point you're probably wondering what the image of HAL 9000 from 2001:A Space Odyssey has to do with DEI.

In a 2020 study, Morningstar research found that there were more UK funds run by people called 'David' or 'Dave' than run by women. One year later and things had improved from 7.2% of funds run by women to 7.7%, but still only marginally. It also showed that in Italy, more funds are run by men called 'Andrea' than run by women. A more recent update though from March 2022 found that the outlook had improved (albeit including a change in methodology) with 17.8% of funds managed by women compared with 7.2% by 'the Daves'. But the point of concern remains. Investment management is still quite undiversified (no pun intended).

A study by Statista found that as of 2022, in the broader financial and insurance sector there were just over one million people involved with 45% women. However, 22% of those women were part-time compare with only 3% of the male employees.

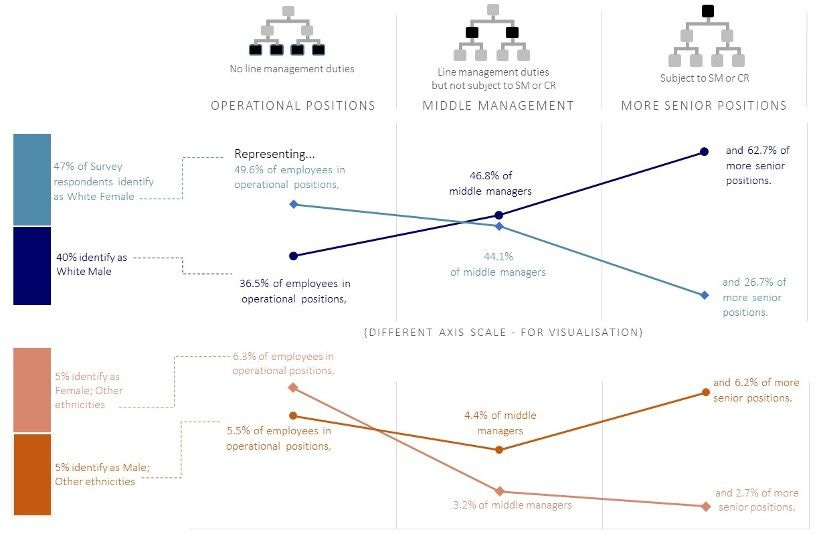

A study by the FSCB in 2020 found that whilst in their survey 52% of respondents identified as female with 46% identifying as male (the balance as other gender including for example non-binary), there was a big drop off in representation from junior to middle management grades particularly when ethnicity was taken into account.

The FCA commented that this

"... risks creating a culture where firms attempt to ‘poach’ diverse senior talent rather than develop their own pipelines. This is not a sustainable approach and is unlikely to bring meaningful, long-lasting change."

"Understanding approaches to D&I in financial services", FCA, Dec 2022.

Does gender diversity really matter for returns?

A paper from Stephen Lawrence, Head of Indexing Research at Vanguard suggested a positive 39 bps per annum outperformance by more gender diverse US active equity teams. You will recall from "Perspective: why relying on the 'diversity tick box' doesn't work" that I introduced my mate Iain who from a demographic diversity standpoint is different to me ('white English' versus 'Asian British/Indian'), but in terms of how we think we are very, very similar having grown up together, had many shared experiences and developed similar values. Considering that, this is particularly interesting:

"This relationship is strengthened by controlling for education quality and non-gender related diversity – suggesting that even among well qualified and otherwise diversely educated teams, gender diversity is important for active equity management."

In fund management, with regulations such as the EU's Sustainable Finance Disclosure Regulation (SFDR), there is focus on the investment process and how corporates are following sustainable practices embodied within the UN Sustainable Development goals, (albeit in practice that is based on the use of data from ESG ratings companies means that in practice it is Environmental, Social and Governance factors).

Asset managers are labelled according to 'how sustainable their investment processes are' and so funds are categorised as follows:

Article 6 have no sustainability scope

Article 8 promote environmental or social characteristics; and

Article 9 funds have sustainable investment as their objective.

So fund managers in Article 9 funds, for example, have a 'sustainable investment objective', but are those fund management firms themselves operating sustainably?

Quis custodiet ipsos custodes?

The Roman poet Juvenal writing in his Satire VI discusses the problem of ensuring marital fidelity. The starting point was, misognyistically, how to ensure the female partner did not cheat. However - and there is debate as to whether Juvenal included this text originally or was added afterwards - the phrase 'quis custodiet ipsos custodes?' or 'who will guard the guards themselves?' was included to say but who is going to stop the men?

The phrase is now used to ask how will power be held to account. So in fund management, we just highlighted SFDR as a standard to hold fund managers to account.

The problem is that it focuses on the investments being made rather than the investing firms making those investments.

Anecdotally it would appear that progress at improving DEI within asset management firms has been slow. We highlighted in Edmans's, Flammer's and Glossner's work that there could be a problem in identifying diversity to begin with using traditional methods. One problem is the changing nature of how we identify to begin with. Traditional demographic methods are fluid. Just look at gender itself.

From that starting point, it could be that corporates and organisations are then approaching DEI in the wrong way. It is not a case of 'add diversity and stir' and the FCA in a review commented that despite firms launching numerous initiatives there had yet been substantial improvements. I think they summarise the issue well:

"We have 3 hypotheses as to why this might be:

1. Diversity and inclusion initiatives take longer to deliver a visible impact than expected.

2. Diversity initiatives alone, without meaningful cultural change driven from the top to embed them and drive inclusion, will not tackle diversity effectively.

3. Some diversity and inclusion initiatives are not effective in delivering change."

"Understanding approaches to D&I in financial services", FCA, Dec 2022.

Ultimately it is about changing the culture of a firm - research is increasingly showing that for asset management it can lead to better performance. A firm's culture is the "weighted-average of values that people truly follow" - that takes effort.

And I could not finish this blog without recommending a book by an ex colleague of mine - Katrina Dudley. Katrina is a portfolio manager and the book that she co-wrote with Ellen Carr makes a compelling case that increasing the number of women could help transform active investment management at a time when it is under threat from passive strategies and technological innovation.