Sustainable Investing weekly blog: 25nd Feb 2022 (Issue 27)

Our weekly summary of the key news stories, developments, and reports that are impacting investing in the wider transition to net zero carbon and a greener/fairer society.

This week, much of the world’s attention (including most investors), is focused, quite rightly, on the war in the Ukraine. Most business newspapers, and many many pages of analyst research, have been filled with views on the immediate impact on companies. For others, again quite rightly, the focus has been on the human suffering and the possible long term impact on the stability of Europe.

With Russia providing around 38% of Europe’s gas, this weeks top story consider the question “will the war accelerate Europe’s efforts to break this link”? In Generation, we review the exit of Korean giant LG Electronics from the global solar panel market, in Electrification, we highlight the expected upcoming SPAC deal for battery swapping company Gogoro , in Agtech, we discuss the emerging industry of fermentation. In Human Rights & Legal, our good friend Kristina Touzenis highlights the EU Commission’s Draft proposal for a new Directive on Corporate Sustainability Due Diligence. A long way of saying, they want companies to be responsible for what happens in their supply chains. We finish with our “one last thought”, this time on the scale of bids for the US offshore wind leases (spoiler alert – they will raise much more than first expected).

The format of the blog is simple, first our summary of the key points of the story (click on the green link to read the original) and then what we think it means for investors. The focus is on news flow that we think should change the markets perception of the investment case of individual stocks and sub sectors. So not the place to come to for news that has already been well covered in say the FT. Our approach is unashamedly long term, so we ignore short term noise.

Top story : Can Europe survive without Russian gas

,Can Europe survive painlessly without Russian gas ? (Bruegel think tank )

Main points of the story as published

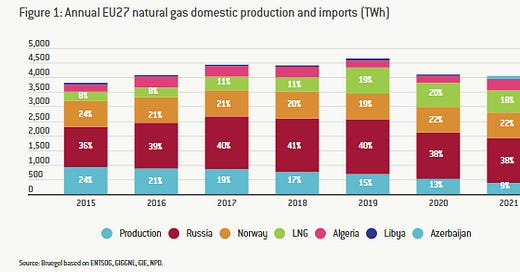

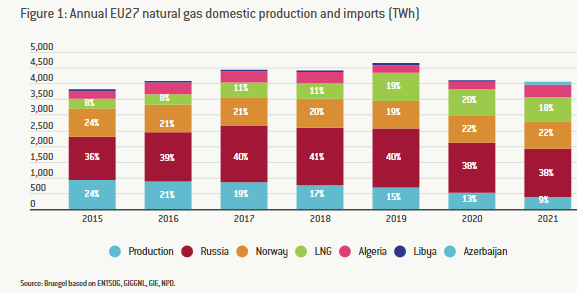

Russia has historically been the European Union’s largest supplier of natural gas. After the 2006 and 2009 Russia-Ukraine-Europe gas disputes, followed by tensions in the wake of the 2013-14 Ukrainian crisis, the EU has sought to reduce its dependency on Russian natural gas imports. However, Russia continues to supply around 38% of EU gas consumption (see chart above).

Until the summer, the EU would likely be able to survive large-scale disruption to Russian gas supplies, based on a combination of increased LNG imports (to the limited extent this is technically possible) and demand-side measures such as industrial gas curtailments. However, this would come at a cost for the EU economy and might even result in some countries (those more exposed to Russian gas and less interconnected with other EU countries) having to take emergency measures.

But, should a halt of Russian gas be prolonged into the next winters, it would be more difficult for the EU to cope. On the supply side some spare import capacity is available but reaching the scale required to entirely replace Russian volumes would be at best very expensive, and at worst physically impossible. The EU would thus need to resort to demand-side measures, which would prove painful for different countries/constituencies.

In the residential and services sectors, energy efficiency could massively reduce the reliance on gas as almost 75% of the building stock is energy inefficient. However, the required investments and physical work are too slow to provide a significant contribution in the near future. So any impact would likely have to fall largely on the Industrial & Power sectors.

Our take on this

Questions on the likely European energy response to the crisis largely revolve around, will this prompt a bigger push into renewables and alternatives, or will the response be “more of the same” ? How this pans out will be a big test of Europe’s commitment to Net Zero. Its possible that it could end up giving a big boost to even more investment in renewables, grid resilience, accelerated electrification of transport & industry, and upgrading our building’s and other elements of the built environment. Put simply, it could push Europe to, over time, break its link with Russian gas.

We know what needs to be funded, more renewables, more interconnectors and more battery storage. The technology is well proven. And the debate within the industry has moved on from how do you cope with c. 20-30% of your supply from renewables , to how to we get past the c. 60% level.

We have to say, the prospects for a dramatic shift currently do not look great. According to a leaked draft of the European Commission’s communication on energy prices due to be published in March, the strategy targets a “more of the same cure”. This includes fossil gas imports, this time from different third countries such as Azerbaijan, Qatar and Turkey.

This response is maybe understandable, given the Bruegel analysis above that suggests a multi year disruption to Russian gas supplies could have material economic impacts on the European economy. The war in the Ukraine might change this approach, as the public push for more urgent action. Again social change driving politics and regulation.

The draft strategy also mentions ‘low-carbon gases’ and significant EU funding for such gases to lower dependence on fossil gas. This includes blue hydrogen, but as the International Renewable Energy Agency says in its recent report on the geopolitics of hydrogen: ‘Blue hydrogen would follow the patterns of gas markets, resulting in import dependencies and market volatilities’. In short, investing more in gas as a strategy to move away from a dependence on Russian gas would potentially worsen, not improve the situation.

If this pans out as the draft report suggests, it is not bad news for the European electrification sector, after all just building what is in existing plans is looking challenging, with permitting highlighted as a particular barrier (not capital). But we perhaps shouldn’t see this as a possible boost.

Electricity generation : LG Electronics exits global solar panel business

,,LG announces exit from global solar panel business (Power-technology)

Main points of the story as published

In a press release LG Electronics Inc. announced it was exiting the global solar panel business. The decision, approved Feb. 22 by the LG board of directors in South Korea, follows a comprehensive review of the impact of increasing material and logistics costs, as well as severe supply constraints, on the solar business.

The company aims to close its solar panel production activities over the coming weeks, but will continue serving its US solar customers and honouring the limited warranties of each product sold. LG added that the decision to close its solar panel business should not affect its other operations at the US Huntsville facility.

Last March, LG Energy Solution announced plans to invest more than $4.5bn by the end of 2025 to expand its battery production in the US. The company also held discussions with General Motors to build a cell production plant in the country as a joint venture.

Our take on this

The press release largely tells its own story. The coverage of the announcement by Nikkei Asia titled LG Electronics exits solar panel business on stiff China rivalry, highlights our interpretation of the decision. LG is not going to be the first company pushed out by competition from Chinese competitors. A combination of government support, different thinking about profitability, and the economies of scale they can achieve in their domestic market, make them fierce competitors, especially where production is modular. Something to watch for other segments of the electrification theme.

Also, while it’s leaving the solar panel manufacturing market behind, LG has committed to continue its focus on developing solar batteries for households and businesses, as part of a reorganisation of its Business Solutions Company. “The company will concentrate on growth sectors and plug into a new era of sustainability through rapidly evolving products and solutions including Energy Storage System (ESS), energy management solutions and other yet-to-be-announced advancements.”

Electrification: battery swapping a growing theme

,EV battery swapping leader Gogoro to be listed next month (Electrek)

Main points of the story as published

The Taipei-based company Gogoro, widely seen as the world leader in swappable batteries for light electric vehicles, will be listed on the Nasdaq exchange by the end of this quarter. Instead of going the traditional IPO route, Gogoro is undergoing a merger with special-purpose acquisition company Poema Global Holdings Corp. The SPAC will see it listed under the ticker GGR.

Gogoro builds several models of fast and high-powered electric scooters designed for urban and suburban transportation, but its core business is built around its swappable battery packs. Those batteries power its scooters as well as the vehicles of a long and growing list of partners.

Large companies like Yamaha have lined up to incorporate Gogoro’s swappable batteries into their scooters, relying on Gogoro’s expertise in energy storage to fast track their own electric vehicle development programs. In less than five years, Gogoro has grown its local Taiwanese subscription base to over 400,000 subscribers who swap batteries in their electric scooters. In that time, the company has reported over US $1 billion in revenue just in its domestic market.

Gogoro has succeeded so rapidly that Taiwan will soon have more battery swap stations than gas stations. Now Gogoro is expanding into the Chinese and Indian markets that dwarf the size of the Taiwanese market. Recently adding the third largest two-wheeler market, Indonesia, the company has placed itself in a very lucrative position to employ its battery-swapping technology in the main two-wheeler markets in the world.

Our take on this

As someone who spent some time in Asia, the success of this format is not a massive surprise. Small scooters are very popular, offering a cheap & easy way of getting around. According to Market Prospects, the world’s top 10 motorcycle and scooter markets are in order: China, India, Indonesia, Vietnam, Brazil, Thailand, the Philippines, the United States, Pakistan, and Taiwan. And Meticulous Research estimates that the market is expected to record a CAGR growth of 28.9% from 2022–2029 to reach $ 625.03 billion by 2029 or c. 266m units.

The challenge in densely populated Asian cities, is where to charge an electric scooter ? Battery swapping is an attractive alternative, especially if it can take place in seconds and if swap stations are easy to find. Many European & US investors tend to think of the EV market as being about passenger cars and charging technology, this is a different market we will follow with interest.

Agtech : “Brewing Up a New Category Of Healthy Oils and Fats”

,Zero acre farms – made with fermentation not deforestation (Vegconomist)

Main points of the story as published

California-based Zero Acre Farms creates fats and oils using fermentation technology to produce both healthier and more sustainably produced versions than those derived directly from crops. The founding CEO argues that traditionally produced vegetable oils are linked to chronic diseases, obesity and deforestation, be it for soyabean or palm oil production. Production of oil crops, the by-products of which are used in intensive animal feedlot operations, has accounted for half the increase in agricultural land use globally since 1961.

The company recently raised US$37m in a Series A round with its first product launch scheduled for later in 2022.

Our take on this

There is growing interest in using fermentation and synthetic biology to produce a range of foods (including chocolate, coffee and peanut butter) as well as alternatives to petrochemicals and other industrial inputs. Nature Biotechnology published a paper this week explaining how bacteria can be used to convert waste gases from steel plants to produce commodity chemicals such as acetone and isopropanol in a carbon negative process.

Fermentation is one of the four food ‘technologies’ we reviewed in our recent report (‘Agricultural technology – Field of dreams’, 9 December 2021 – ask Dan via dan@sustainableinvesting.co.uk for a copy). The others are plant-based, cultured meats and insects. While it has the lowest profile of the four, it perhaps offers the greatest potential and is certainly the most versatile with uses extending into industry.

There are three broad families of fermentation technologies: traditional, biomass and precision. Traditional comprises the production of alcohol, bread and dairy products among others. With biomass fermentation, the microorganisms that reproduce are themselves used to make alternative proteins such as Quorn. With precision fermentation the microorganisms are programmed, using synthetic biology techniques, to produce specific ingredients naturally found in animal or plant foods. Examples include milk proteins; the haem (yes, that is the correct spelling) used by Impossible Foods; and fats such as from Zero Acre Farm’s. And as noted above, precision fermentation also has industrial applications.

It remains a young industry; the median age of a fermentation tech company is less than four years compared to closer to 10 for alt-protein companies in general. Growth is however rapid with annual VC investment nearing US$1bn in 2020 compared to c. US$10m in 2015 and US$50m in 2018. Unlike many of the plant-based and cultured meat companies, the majority of fermentation companies are pursuing B2B not B2C strategies. As we noted in our agtech report , routes to market and distribution are major challenges for start-ups especially in the foodtech space.

Human Rights : EU draft proposals on corporate sustainability due diligence

This week our good friend Kristina Touzenis, who has many years experience in the human rights field (LinkedIn profile here), has again kindly guest written the human rights, social & legal section of the weekly. Thank you Kristina. Just a reminder, this section is not written and prepared by Sustainable Investing LLP. Quite frankly, we are not experts in this field, so we leave the topic to those that are.

This week she starts reviewing (its a big document, so expect more over the coming weeks) the recently released (& snappily titled) “Proposal for a Directive on corporate sustainability due diligence” (document here). From our discussions with Kristina, our take is that the long delayed document (first due back in July 2021 if we recall correctly), might not be such a big deal legally as many seemed to expect (& hope for). Certainly, organisations such as the European trade unions seem disappointed.

The Commission proposal will be subject to amendments and approval by the European Parliament and governments over the coming months and years. And of course, various parallel legislative processes are advancing in different countries across Europe, so we may find some countries look to “fill in some of the gaps”.

Now over to Kristina….. on 23 February 2022, the EU Commission unveiled its Draft proposal for a new Directive on Corporate Sustainability Due Diligence. The Directive aims to prevent and remedy human rights and environmental abuses involving private companies throughout global value chains. For the first time, EU companies could be held liable for human rights violations and environmental degradation committed in the EU or in third countries by their subsidiaries, contractors or supplies. Victims could also file lawsuits and seek compensation in domestic courts of EU Member States, even if the harm occurred abroad.

There is no doubt that this directive is a milestone. However current limits in the legal scope would reduce the applicability of the law significantly. Additionally, it remains to be seen if monitoring mechanisms or other accompanying measures will be put in place. It is feared that companies could fulfill their legal obligations by just adding certain clauses in their contracts with suppliers.

That said it will no doubt influence conduct and should not be dismissed before we see how implementation will be dealt with. Its a first step in a clear direction of increased expectations of conduct on business. Its something we will watch closely as it makes it way through the often slow approval process.

One last thought

,,Wind companies bid more than $3bn for US offshore leases (FT)

Perhaps in different circumstances, this might have been a full story. In summary, the auction of 488,000 acres off New York and New Jersey for wind farms has drawn in bids totaling $3.35bn, as of last Thursday. This weeks auction was the first since 2018, when the sale of 390,000 acres raised only $405m. The current auction is the first of many (up to seven rounds), that are planned to be done between now & the end of 2025. Further sales are planned off the coasts of the Carolina’s & California. Editors note – since we first wrote this the total raised has apparently increased to nearly $4.4bn.

Just to finish up – there was some debate around what the one last thought for this week should be. No 2 was , Beyond Meat takes a beating, with our favorite quote being “ and consumers were not making repeat purchases because the products were not meeting expectations in terms of price and how processed the food is”. Regular readers will know this second point is one of our issues as well.