Topics:

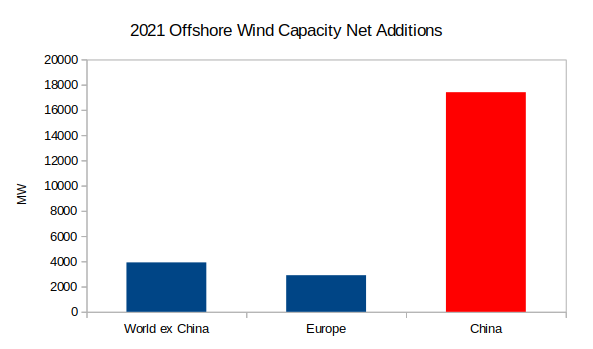

Electricity systems: China to build world’s largest offshore wind farm - The city of Chaozhou, in Guangdong province, is planning to build a 43.3-gigawatt (GW) offshore wind farm. Reminder - current global capacity is only 54GW, so this would be big. But it’s possible, in 2021 China built more offshore wind, than the rest of the world had managed in the previous 5 years. More competition!

Health: Acute Kidney Injury deaths potentially linked to syrup medicine raw materials - Deaths of children in Indonesia and Gambia potentially linked to medicinal raw materials highlights the importance of strong governance of supply and value chains. Sadly, this is not the first time, and it will not be the last.

Energy alternatives: Energy Charter Treaty seen as incompatible with climate commitments - France becomes the latest European nation to withdraw from the Energy Charter Treaty (ECT). A collapse of, or a restructuring of, the ECT could accelerate the stranding of fossil fuel assets. Investors need to understand the associated risks and transition plans that O&G companies have in place.

Ag & natural capital: Vertical gardening providing food and cooling - Heat exposure is likely to increase due to the impacts of climate change and whilst high tech solutions exist, simpler solutions such as vertical gardening can provide cost effective cooling and provide a limited source of local food. Small can be powerful and investable.

Built environment: Wind turbines designed for roof tops - Well, not really turbines. Here the wind is drawn in between two airfoils, similar to airplane wings. They create a negative pressure that sucks the wind that’s hitting the building through an internal propeller on the bottom of the unit. It’s undergoing trials - so one to watch. A great fit with solar and batteries for local distributed energy?

Transport: Will Foxconn do for EV’s what it did for smartphones - They want to build EV’s for others, targeting 5% market share by 2025, with a dream of over 40% market share. Yes, this sort of outsourcing might come one day, but this feels too soon. Most major OEM’s are currently reluctant to let someone else build their cars for them, basically if they don’t what are they there for?

Human rights: The Texas Two step - It’s not illegal, but it’s something that ESG investors might feel uncomfortable with. 3M, the subject of the largest mass tort law case in US history, wants to adapt a bankruptcy structure that will effectively halt the case in its tracks. Let’s think how we explain this to our clients.

Transitions: Bringing locals to projects with crowdfunding -allowing locals to share in the economics of renewable energy projects and other initiatives could overcome NIMBYism. With the right support from investors, these sorts of programmes could prove more effective than national rollouts.

The Sustainable Investor: our weekly summary of the key news stories, developments, and reports that are impacting investing in sustainability, the climate related transitions, and a greener/fairer society. The important word in this sentence is investing - unlike many other blogs our focus is on the issues we think investors need to be aware of and think about.

If you want to be helped to move forward on the long-term issues being faced by sustainable investors, please subscribe and support our work or even better subscribe and share (see the button at the end of the blog).

Electricity generation: China going big in offshore wind

Chaozhou plans world's largest offshore wind farm (electrek)

What is the big investing theme -100% (or close to) renewable/low carbon electricity generation systems are looking more viable with each passing year, supported in many cases by long distance interconnectors, demand management and storage. Offshore wind, while more expensive, has better operating characteristics. China is accelerating into this theme, which could have material consequences for the profitability of global wind turbine makers and installers.

In a nutshell - what does the story say?

The city of Chaozhou, in China’s Guangdong province, is planning to build an offshore wind farm so large that it is expected to provide more power than all of Norway’s power plants combined. The city intends to start work on the 43.3-gigawatt (GW) offshore wind farm before 2025, according to the city’s five-year plan, which is published online. The plan does not disclose how much the offshore wind farm is expected to cost.

The wind farm will be built between 47 and 115 miles (75 and 185 km) off the city’s coast, on the Taiwan Strait. “The area has unique topographical features that mean wind will be strong enough to run the turbines 3,800 to 4,300 hours a year, or 43% to 49% of the time, an unusually high utilization rate,”

Why do we think it is important for investors?

China is rapidly becoming an offshore wind powerhouse. China become the world’s largest offshore wind market last year, overtaking the UK. In 2021, the country erected 16.9GW new turbines offshore, taking the cumulative installed capacity to just under 26.4 GW. Taken together, local plans point to a collective incremental capacity of 58.54GW (yes, we have trouble reconciling these figures as well) to be installed between 2021 and 2025, while the local authority’s long-term plans for offshore wind amount to over 150GW.

Perhaps more importantly for investors, Chinese wind turbine maker Goldwind, recently supplied a giant 13.6 MW offshore wind turbine. The diameter of the impeller is 252 meters, and the swept area is about 50,000 square meters. At full wind speed, a single unit can generate 29 kWh of electricity per revolution and can output 63.5 million kWh of electricity pa. Given the progress that China has made in solar panels, batteries, and EV’s, it’s worth watching Chinese manufacturers, with the potential for the global turbine market to become even more competitive.

Health: Acute kidney injury deaths potentially linked to syrup medicine raw materials.

Indonesia child deaths from acute kidney injury rise to 141 (Reuters)

What is the big investing theme -Providence of products and raw materials is a key risk factor for any manufacturer. It is essential that companies have appropriate governance measures for their supply chains (and downstream distribution) and have action plans for dealing with disruption to supply and/or sales.

In a nutshell - what does the story say?

There have been 141 childhood deaths from Acute Kidney Injury (AKI) in Indonesia. A separate article reported that there have been more than 240 cases of acute kidney injury in children in Indonesia across 22 provinces with the majority of cases amongst children under five years old.

The cause is thought to be high levels of ethylene glycol and diethylene glycol in some syrup-based medicines although this is not confirmed. Gambia saw at least 70 child AKI deaths recently. Health Minister Budi Gunadi Sadikin commented that changes in raw ingredients were likely to blame although this has not been verified.

China and India are the chief exporters of medicinal raw ingredients to Indonesia. It has been separately reported that all syrup-based medications have been temporarily banned in addition to five locally-made products. Indonesia’s Food and Drug Agency (BPOM) is considering prosecuting two as yet unnamed pharmaceutical firms.

Why do we think it is important for investors?

In reading this, we are reminded of three scandals from Sandy’s time living in Hong Kong that are a reminder of the importance of strong governance and planning with supply chain. All were health related, but with different causes, from different industries, handled in different ways and leading to very different outcomes for the stocks. We shall cover these in more detail in a long blog.

The 2008 melamine scandal that hit the entire milk industry, impacting both domestic and foreign producers, led to significant prosecutions (including two death penalties) after more than 50,000 children were hospitalised with resulting kidney stones and other damage.

In 2010, Bawang shampoo was claimed to contain cancer-causing chemicals. Whilst strictly speaking true, the levels were not dangerous or particularly different to any other foaming product. However, a lacklustre, almost dismissive response from the company led to share price and market share declines that the company never recovered from.

Finally, in 2012, Samsonite’s “Tokyo Chic” suitcases were accused by a Hong Kong consumer group of having high levels of compounds linked to cancer in their handles. Samsonite recalled 250,000 cases globally despite independent tests showing no health threat. The stock price recovered within two weeks.

Energy use: Energy Charter Treaty incompatible with climate commitments

France is latest to withdraw from Energy Charter Treaty (Euractiv)

What is the big investing theme -If we are to reduce O&G usage, there will be a whole series of costs we as a society may need to face. Some are to do with compensation for stranded assets (an unpopular topic) and some are to do with cleaning up the existing infrastructure. This is a theme that could get material and run for many decades.

In a nutshell - what does the story say?

President Macro announced that France will withdraw from the Energy Charter Treaty as it is “incompatible with the country’s climate commitments” - in particular the 2030 decarbonisation timetable. France joins the Netherlands, Spain and Poland in announcing their withdrawal.

A co-author of the recent IPCC report asked if Brussels would consider withdrawing from the Treaty at the EU level, a request that received support from France’s High Council for the Climate (HCC).

Why do we think it is important for investors?

The Energy Charter Treaty (ECT) was originally conceived as a way to protect foreign investments in the energy sector, particularly in the aftermath of the collapse of the Soviet Union. Under the ECT, investors and energy companies from one state are able to sue other member states if they feel that they have been treated unfairly - that is where the troubles began.

A study in May concluded that governments seeking to limit fossil fuel production to reach net-zero emissions globally by 2050 could face legal claims of up to US$340 billion from fossil fuel producers under a mechanism called the Investor-State Dispute Settlement (ISDS). Most ISDS claims could be brought under the ECT. Indeed, in February of 2022, RWE, Uniper and Rockhopper used the ECT to sue four European governments for €4 billion over their climate change policies. Uniper was forced by the German government to drop that lawsuit following a bailout of the company.

In June of 2022, member countries had reached a provisional agreement to reform the mechanism, with countries able to remove protections for existing fossil fuel investments on their territory - 10 years after the revised mechanism comes into force. The scope has also been increased to include hydrogen and synthetic fuels like SAF. However, the 10 year timeline has received criticism for being too long, for example taking us beyond the 2030 UN SDG timeline.

Clearly a collapse of or a restructuring of the ECT could accelerate the stranding of fossil fuel assets and investors need to understand the risks associated with that and transition plans that those companies have in place.

Ag & natural capital: Vertical gardening providing food and cooling

Growing plants on buildings can reduce heat and produce healthy food in African cities (The Conversation)

What is the big investing theme -Climate change and climate-induced migration could increase the number of people exposed to extreme weather, including heat stress. The built environment is an important sustainability theme, both as an integral part of societal existence but also a major decarbonisation (40% of energy-related GHG emissions) and resource consumption problem (40% of global raw materials) that needs investor attention. Including residential and commercial buildings, communal areas such as parks, and supporting infrastructure such as energy networks, mobility, and water supply, it can have significant impacts on our health, well-being and equity & inclusion.

In a nutshell - what does the story say?

Heat exposure in Africa is expected to reach 45 billion person-days (annual number of days when temperature is more than 40.6 degrees Celsius multiplied by the number of people exposed) by 2060 from 2 billion per annum between 1985 and 2005. A study in Akure, south-west Nigeria highlighted that poorer neighbourhoods were more disadvantaged and had a lower capacity to adapt to heat. More than three quarters of richer households had air conditioning units compared with just over a fifth in poor neighbourhoods.

Studies in Akure, Lagos and Dar es Salaam demonstrated that vertical greening/gardening systems could be an effective solution for heat problems in informal neighbourhoods as well as providing a source of healthy food. A typical set up produced up to 1kg of vegetables harvested in a six-week cycle. Indoor wall temperature reduced by as much as five degrees Celsius in the Dar es Salaam trial.

Why do we think it is important for investors?

Solutions for keeping buildings such as homes or offices at an appropriate temperature are not universally effective regardless of geography. Creating scalable and appropriately designed equivalents of vertical gardens could be a cost effective way of providing cooling with locally grown fruit and vegetables as a side benefit! Simply expanding the use of air conditioning units is both expensive and additive to electricity demand.

Other simple solutions include windcatchers or cooling towers have been used extensively in North Africa, Asia and the Persian Gulf for thousands of years. They can passively cool buildings and also provide cross ventilation. Their effectiveness is dependent on local weather and microclimate conditions but they continue to function when power fails and are generally cheaper to construct than traditional HVAC systems. In the UK, Oast houses are examples, but some shopping centres have experimented with them as well, including Bluewater shopping centre in Kent.

Built environment: Turbine free wind turbines for roof tops

Mini turbines designed for rooftops (Fast Company)

What is the big investing theme -If we are to decarbonise our energy system, local distributed energy is going to play an important role. Local solar, wind and batteries could make communities largely self-sufficient. And this is not just a developing world issue, microgrids, as they are known, can also aid grid resilience in developed markets. We are all familiar with how quickly roof top solar has expanded, but local, small scale wind turbines have been less successful.

In a nutshell - what does the story say?

A typical wind turbine is massive—roughly as tall as the Statue of Liberty, with blades that stretch wider than a football field. (Some are even bigger, like a new offshore turbine from Siemens that has a 774-foot-wide rotor.) By contrast, this new 10-by-10 foot turbine is relatively tiny. And without moving blades, it isn’t immediately recognizable as wind energy tech. The devices, designed by a startup called Aeromine, are meant to sit on the edge of a rooftop instead of out in a field, and can work alongside solar panels.

When it’s perched on a roof, the tech uses the aerodynamic effect of the wall below it. The building amplifies the wind speed, and the wind is drawn in between two airfoils, similar to the shape of airplane wings. As the wind hits those airfoils, it creates a negative pressure that sucks the wind through an internal propeller on the bottom of the unit, which creates the energy production.

Why do we think it is important for investors?

Regular readers will know that we are big fans of the potential for local distributed energy and microgrids. But a gap in the armoury of this type of solution is wind turbines, which can help to balance out periods when there is no solar generation. Some locations can have standalone wind turbines, but rooftop wind is challenging—spinning blades are noisy, distracting, and (like their larger counterparts) can kill birds.

If rooftop wind and solar together can work, in industrial complex’s and on apartment buildings, the need for expensive battery storage can be reduced. This can provide an alternative energy source for EV charging, and for building heating and cooling, reducing the reliance on utility scale infrastructure. Its early days for this particular solution, but it’s a theme worth watching.

Transport: Will Foxconn build your next EV ?

Foxconn wants to build EV's for Tesla (cleantechnica)

What is the big investing theme -There is a big debate around what will make a successful EV company. There will almost certainly be a place for the luxury brands and another for the small mass market runabout. But what happens in the middle market, a currently large market segment. Here brands are losing their impact and as EV’s start to dominate, engine design becomes less important. OEM’s need to cut costs - leading to questions about outsourcing, or even abandoning the segment altogether.

In a nutshell - what does the story say?

Foxconn has made a nice business for itself by manufacturing products for other companies. It makes most of the iPhones Apple sells but is relatively unknown to consumers because its name doesn’t appear on many of the products it manufacturers. Chairman Liu Young-way said the company wants to leverage its manufacturing expertise to become a major manufacturer of electric cars.

“Based on our past records for the PC and cellphone markets — we’re at about 40–45% of the overall market share. So, ambitions-wise, hopefully we are able to achieve the same kind of achievement like in the information and communications technology industry, but we will start small, which is about 5% in 2025,” Liu said. “I hope one day we can do Tesla cars for Tesla.”

Why do we think it is important for investors?

As we highlight in the “why is this theme important” section - mid market OEM’s will need to think hard about how they brand and manufacture cars in an age of EV’s. One option is to outsource to a specialist, someone who helps create scale and can work on engineering redesign. This is already happening in a small way, mainly for OEM’s who lack the scale to run a large assembly line.

Maybe one day, but we cannot see this happening soon. Apple is happy to be an R&D and design agency, we struggle to see say Renault doing the same. If they don’t make the battery and they don’t put the car together, what value do they add?

Human Rights: Mass tort and the Texas Two Step

Texas two step - the US legal move letting corporations off the hook (FT)

What is the big investing theme -Human rights has a broad scope. We traditionally think about it in the context of supply chains, or mine tailing dam collapses, or the murder of human rights defenders in LatAm (all stories we have covered). But at its most basic, it’s about access to the protection of the law, being able to have your case heard and decided fairly.

In a nutshell - what does the story say?

3M faces the largest mass tort case in US history, over earplugs that apparently didn’t work and hence were responsible for hearing loss. There are 230,000 personal injury claimants, including many from the military. But, if 3M gets their way, using a controversial bankruptcy strategy, the claimant’s might not get their day in court.

The plan is simple, split the company into two, and ringfence the liabilities in just one of them. The split is commonly known as a Texas Two step, a catchy title that sounds harmless. However, the legal manoeuvre has attracted criticism from Congress, with Senate Democrats saying they will draft a bill to outlaw the move.

Other companies that have used similar strategies include J&J (over claims relating to their baby talc) and French cement group Saint Gobain (over asbestos claims).

Why do we think it is important for investors?

We are not lawyers, although we did a fair bit of digging a while back in relation to the J&J case. And, as far as we can tell, its legal, at least for now. So, we are going to stick to a simple question. If you are an ESG investor, who owns shares in one of the companies involved, how do you explain this to your clients. Answers on the back of a postcard please.

Transitions: Bringing in locals to local projects with crowdfunding

IBC Solar launches Public Participation Portal for PV projects in Germany (Renewable Energy Magazine)

What is the big investing theme -Whilst climate change and associated impacts are a global problem, some solutions will have to be local to be effective. It’s that simple.

In a nutshell - what does the story say?

IBC Solar has partnered with EUECO to develop a digital platform to encourage citizen participation in German solar parks and the generation of green energy. The first scheme, the Schnaid solar park in Hallerndorf in the district of Forchheim, will supply 7,000 MW hours of green electricity per year, with construction set to begin in 2023. The 6.5 MW peak capacity park will save 4,300 mt of CO2 emissions annually and could supply 2,000 three-person households for a whole year. Two further public participation schemes, near Bad Staffelstein, are being planned, with more to follow.

Why do we think it is important for investors?

NIMBYism (“Not In My Back Yard”) has often been a barrier to deployment of renewable projects such as wind or solar (although solar projects have typically faced far less opposition). Research from LSE found that UK residential property prices saw between a four and five percent reduction where sited within two kilometres of a wind farm, falling to zero impact on price beyond four kilometres. However it also pointed out the difficulties in perfectly isolating causality.

However, engaging locals in the economics of projects can overcome NIMBYism where locals can also share in the benefits of land price increases, cheaper electricity, and subsidies. A German study found that about 18 percent of expected wind turbine profits are capitalised into land prices. Ripple Energy is an example of a similar programme in the UK but with direct fractional ownership of a wind farm supplying energy into the grid and ultimately to the consumer’s home. Minimum investment is £25 up to a maximum of what would generate 120 percent of the individual consumer’s annual electricity consumption.

Local fractional ownership can extend beyond renewable energy projects. For example, when it appeared as though Halley’s Comet would return sooner than high speed broadband would be installed in Sandy’s village, a community interest company was formed to take matters into our own hands and install high speed broadband for the village, managed for the village. We discussed various other local solutions in our “Decarbonising the Built Environment: Simple and Ancient” blog including building a network of local trusted tradesmen for insulation installations or boiler calibration etc. With the right support from investors, these sorts of programmes could prove to be more effective than national rollout programmes.

Image credits - IBC Solar, Nadachka, Kiwi Thompson, Mufid Majnum, redvelvetcake5, David, M., Cevallos, F., “More than just a green facade: vertical gardens as active air conditioning units” December 2016, Energy Charter.org, Foxconn, and Aeromine

Now the legal stuff. Our blogs and all website content are solely for informational purposes and should not be construed as investment research (as defined by the FCA and other regulators). Nor does it have regard to the specific investment objectives, financial situation or particular needs of any specific recipient - it's not investment advice. We (being the writers of The Sustainable Investor blogs and the publishers of related websites) do not promote funds or suggest you buy or otherwise invest in specific securities or other financial instruments. Any reference to a company is illustrative only and should not be seen as a recommendation or a comment on valuation. You should not rely on the blogs, data or other information provided for making financial decisions. You should consult with an appropriate professional for specific advice tailored to your situation and/or to verify the accuracy of the information provided herein prior to making any investment decisions.